From July 1, 2023, superannuation contributions to employees’ superfund increased from 10.5% to 11%, bolstering retirement savings for eligible Australian employees. To gain a better understanding of the superannuation guarantee, we’ve compiled a comprehensive guide that explains SG contributions and their significance for you.

What is the super guarantee?

The Superannuation Guarantee (SG) is the mandated contribution that you must make to your employee’s superfund, forming a crucial part of their salary package. Prior to July 1, 2023, it stood at 10.5% of the pre-tax income but has now increased to 11%. This financial commitment ensures that eligible employees receive adequate savings for their retirement. It’s a statutory obligation for employers to make these contributions, and the government periodically adjusts the percentage.

These contributions form part of concessional contributions. Employers are required to fulfill their quarterly SG contribution obligations to eligible employees to support their retirement, reporting them electronically according to government regulations.

Current SG rate

The SG rate is calculated as a percentage of your employee’s ordinary time earnings (OTE) that you’re required to contribute to their superfund. This rate is progressively increasing and is set by legislation to reach an ultimate annual rate of 12% by July 1, 2025. You can refer to the table below to determine the rate for the specific financial year.

As an employer, it’s crucial to meet your SG obligations by paying the required contributions into your employees’ super accounts by the quarterly due date.

Failure to do so can result in the need to pay a Superannuation Guarantee Charge (SGC) to the ATO. The SGC encompasses the outstanding SG amounts owed to your employees, along with accrued interest and an administration fee.

To avoid these consequences and be eligible to claim a deduction, it’s essential to ensure on-time SG payments into the correct super fund and promptly report and rectify any missed payments by lodging an SG Statement.

Need to know – Am I an employer?

Determining your status as an employer can be less clear-cut in today’s varied work arrangements. The ATO defines you as an employer if you engage workers under verbal or written employment agreements, whether they are full-time, part-time, or casual. Additionally, you may be classified as an employer if you compensate a contractor, verbally or in writing, primarily for their labor.

It’s important to recognize that the definition of an ’employee’ for the purpose of entitlement to SG contributions is detailed in Section 12 of the Superannuation Guarantee (Administration) Act 1992 and differs from the definition in tax law. Further clarification on this definition can be found in Superannuation Guarantee Ruling SGR 2005/1.

Who’s eligible for the super guarantee?

Generally, an employee is eligible for SG contributions regardless of whether you’re a full-time, part-time or casual employee, including if an employee is a temporary resident.

An employee is also typically eligible if: an employee is under 18 years old, or a private or domestic worker, doing more than 30 hours a week as a contractor, even if you’re working under your own ABN, although this is only in some instances an older employee, who might’ve already begun accessing some of their super.

Need to know:

Up to 30 June 2022, employers were only required to make SG contributions for employees earning $450 or more (before tax) in a calendar month. This monthly threshold was abolished from 1 July 2022, so employers are now required to make contributions for almost all their employees.

Self-Employed Super Rules

If you’re self-employed, such as a sole trader, you’re not required to make SG contributions for yourself into a super fund. However, if you operate your business through a company or trust, the rules may vary.

Regardless of your situation, it’s worth considering making voluntary contributions to your superannuation to proactively save for your retirement.

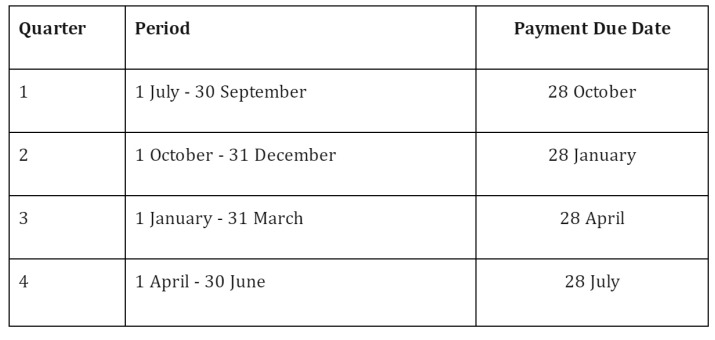

When are SG contributions paid?

Here are the key points regarding SG contributions and potential actions if there are issues:

Payment Frequency: Employers must make SG contributions into employees superfund at least four times a year on or before ATO-determined dates tabled below:

Alternatively, an employer can choose to pay more frequently, such as weekly, fortnightly, or monthly.

Late or Incorrect payments

If an employer has not paid the SG contributions in full by the due date or in the right superfund account, Superannuation Guarantee Charge (SGC) must be paid to the ATO which is then paid the SG shortfalls and interest accrued on shortfall to the employee’s superfund.

Salary Sacrifice

From 1 January 2020, any salary sacrifice super contribution made by an employee would be considered as an additional contribution and will not count towards an employee’s SG entitlement or reduce the Ordinary Time Earnings in order to calculate the SG entitlement.

Who’s not eligible to receive SG contributions?

- Employee under 18 years old if working less than 30 hours in a week

Worker paid to do work of a private or domestic nature unless the work is more than 30 hours in a week.

For additional assistance in assessing your employees’ eligibility for the Super Guarantee (SG), consider using the ATO’s Super Guarantee eligibility tool. This resource can also aid in determining if any of your contractors should be regarded as employees for superannuation purposes.

IMPORTANT – The tool involves a series of inquiries about the specifics of your work arrangement with the individual and offers a written decision regarding their eligibility for SG contributions. Please bear in mind that the accuracy of the decision depends on the accuracy of the information you provide.

Managing SG Contributions with RV Advisory Group

When it comes to effectively managing your Superannuation Guarantee (SG) contributions, seeking professional assistance can be a valuable step. Accountants and agents play a crucial role in ensuring compliance with SG requirements and optimizing your superannuation strategy.

At RV Advisory Group, our team of experts can provide tailored advice and guidance to help you stay on top of your SG obligations. We understand the complexities of superannuation regulations and can offer solutions that align with your specific needs and financial goals.

For professional assistance and insights, feel free to reach out to us:

Phone: (03) 9424 2774

Email: reetika@rvag.com.au

Let our experienced professionals assist you in managing your SG contributions effectively.

Leave A Comment