HIRE A DEDICATED AUSTRALIAN TAX PREPARER

Reliable Offshore Tax Preparation Support

Struggling with tax season workloads or tight deadlines? Outsource your Australian tax preparation to experienced professionals trained in Company, Trust, Partnership, and Individual tax returns—delivered under Australian oversight with accuracy and compliance.

Outsourced Australian Tax Preparation

Our Australian Tax & Compliance division supports Australian accounting practices and SMEs with the preparation of Company, Trust, Partnership and Individual (CTP/CTI) tax returns. With Australian oversight and a skilled offshore team in India, we deliver accurate, timely and compliant outcomes for your clients.

We are proudly Australian-owned and led by an Australian Certified Tax Agent, giving firms the confidence of local expertise combined with the efficiency of our India-based Shared Service Centre. Our CA and CPA-qualified professionals bring experience across Australian accounting standards, tax legislation, workpapers, reconciliations and cloud-based tax workflows.

With years of supporting Australian practices, our team processes a wide range of tax-related work including trial balances, financial statements, year-end journals, interim accounts, CGT calculations, tax planning support, BAS/GST data preparation, and reconciliation files. Every file is reviewed through a structured workflow to maintain high accuracy and alignment with Australian compliance requirements.

Working with RV Advisory Group Services allows your firm to scale quickly, reduce operational burden, and manage compliance workloads more efficiently — while maintaining the quality and review standards expected in Australian public practice.

Software We Use

We support and work with most Australian accounting and tax platforms:

How We Charge

For Australian Accounting, Bookkeeping & Public Practice Firms, our pricing is structured to offer flexibility and efficiency:

This resource is a qualified accounting professional with strong tax preparation experience and is supported by the review of an Australian Certified Tax Agent.

Monthly fees vary based on skill level and hours required.

Whatever your workflow or volume, our Australian-led Tax & Compliance team will help you build a reliable, scalable and cost-efficient outsourcing solution tailored to your practice.

OUR FOCUSED INDUSTRIES

Industries We Serve

Hotels & Restaurant

Trades & Construction

Retail

Health & Fitness / Medical Practices

Automotive

NDIS / Childcare / Education

Vet / Pet Services

Real Estate

Tourism & Travel

E-Commerce

Franchises / Starting a Business

Healthcare

FREQUENTLY ASKED QUESTIONS

FAQs Before Starting off With Us

Unlock Insights and Find Solutions in our FAQ Page for Hassle-Free Knowledge! We have designed the questionnaire to address all your concerns.

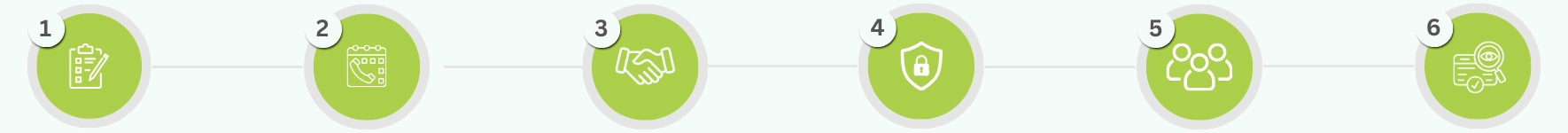

STARTING IS EASY AND IMMEDIATE

YOUR ONBOARDING PROCESS

We make onboarding seamless so your outsourcing can begin in less than 24 hours.No setup fees. No long onboarding. No complexity.

Complete a short contact form

We schedule a call to understand your workflow, files and expectations

Sign a simple Services Agreement

(no minimums)